Difference between buying a put option and selling a call option

When Should I Sell A Put Option Vs A Call Option? - Video | Investopedia

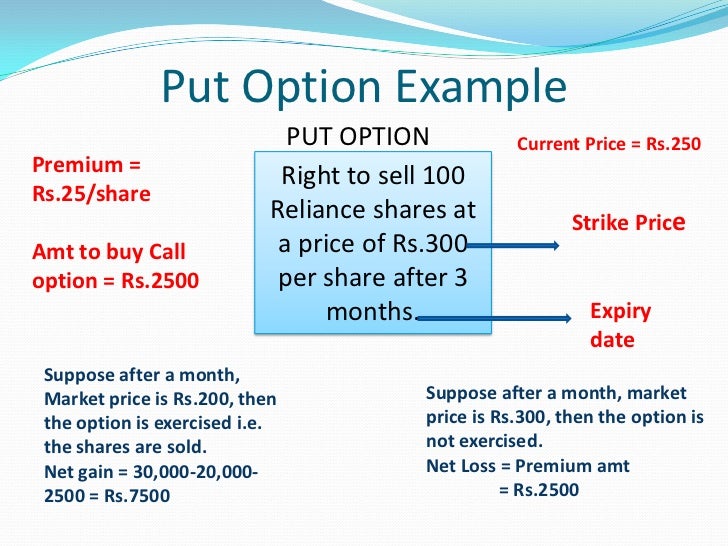

Beginning traders often ask not when they should buy options, but rather, when they should sell them. Answering that question requires an understanding of the option itself , as well as the payoff it should generate. An investor should sell a put option if he thinks the underlying security is going to rise.

And the seller gets to keep the premium. An investor should sell a call option if he thinks the underlying security is going to fall.

The buyer pays a premium to the writer for the right to buy the underlying at the strike price if its price climbs higher. Again, the seller keeps the premium.

Many advanced option strategies require investors to sell options. They include the covered call, the iron condor, the bull call spread, the bull put spread, and the iron butterfly. Knowing when to sell is part of the strategy.

Dictionary Term Of The Day.

The Difference Between Call and Put Options

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

When Should I Sell A Put Option Vs A Call Option? Learn the top three risks and how they can affect you on either side of an options trade.

Discover the option-writing strategies that can deliver consistent income, including the use of put options instead of limit orders, and maximizing premiums. As long as the underlying stocks are of companies you are happy to own, put selling can be a lucrative strategy.

All investors should be aware that the best time to buy stocks is when the market is tanking, according to history. Options offer alternative strategies for investors to profit from trading underlying securities, provided the beginner understands the pros and cons.

Buying Puts vs. Selling Calls. An Explanation for Rookies. - Options for Rookies

Trading options is not easy and should only be done under the guidance of a professional. A brief overview of how to profit from using put options in your portfolio. An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.