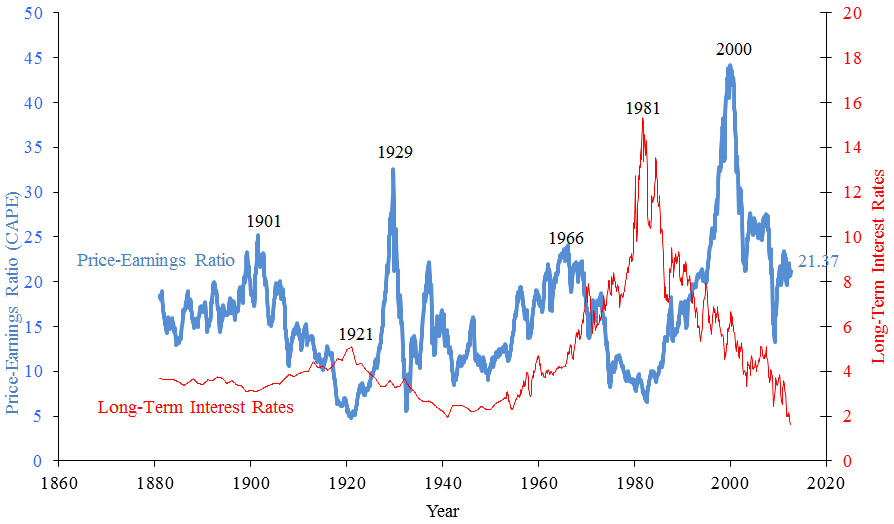

Shanghai stock exchange price earnings ratio

In real market economies, stock crashes of such magnitude may cause heartburn but unlikely precipitate frenzied government efforts to prop up equity prices.

But China is, as we know, not exactly a market economy and has a government that acts differently. In response to the latest crash, instead of allowing market forces to self-correct, Beijing is rolling out aggressive measures to keep the bubble from popping completely.

Besides financing the bubble with new money, the Chinese government has suspended IPOs, cut trading fees, and relaxed requirements on margin loans for example, Chinese retail investors can now use their apartments as collateral.

Beijing worries that a market crash could create, through the shadow banking system, financial contagion that, in turn, will accelerate the bursting of another much bigger bubble: There are, however, two less charitable explanations for China's latest moves.

First, Chinese leaders tend to view economic issues from a purely political perspective.

SSL Stock Price & News - Sasol Ltd. ADR - Wall Street Journal

Unsurprisingly, the performance of the stock market has been made a barometer of the popularity of the current regime. A plunging market would imply a loss of confidence and falling popularity of the current leadership—an intolerable prospect. Second, those who have watched how China deals with bubbles know that its leaders have little faith in market forces but excessive confidence in their ability to sustain bubbles.

Error (Forbidden)

In addressing the real estate market bubble, Beijing has opted to keep insolvent developers alive by forcing their lenders to roll over the loans.

Consequently, the glut of unsold inventory hangs over the real estate sector.

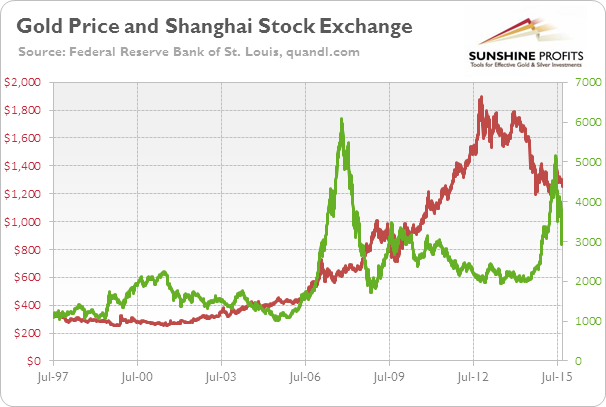

SHANGHAI STOCK EXCHANGE

Because there is such an excess in the supply of housing, it is unlikely that those zombie real estate developers will return to life and pay their creditors in full.

Beijing has used a similar recipe for shoring up its debt-laden local governments.

Fortunately for Chinese leaders, they have not paid a heavy penalty for supporting these bubbles. At least not yet.

SHCOMP - Shanghai SE Composite Index - sotoyege.web.fc2.com

It is also likely that, in deciding to intervene in a crashing stock market, Beijing believes that it can again get away with market-defying policies. Even after its recent plunge, Chinese stock prices are overvalued. Efforts to support the market at high valuations are expensive and unlikely sustainable.

Beijing is trying to save the stock market bubble while three other bubbles have yet to deflate: It's possible that these bubbles will feed into each other, amplifying distortions and raising the final bill to clean up the mess. Right now, Beijing should be building social safety nets and recapitalizing its banks, not betting the house on a stock market bubble.

Officials Say Russian Hackers Targeted 21 States During the Presidential Election. Reddit Reddit Co-Founder Alexis Ohanian Is Using His Own Site for Parenting Tips.

A Chinese stock investor. Customer Service Site Map Privacy Policy Advertising Ad Choices Terms of Use Your California Privacy Rights Careers. All products and services featured are based solely on editorial selection.

Stock Market Basics - Earnings Per Share (EPS) and Price Earnings Ratio (PE Ratio)FORTUNE may receive compensation for some links to products and services on this website. Quotes delayed at least 15 minutes.

Market data provided by Interactive Data. ETF and Mutual Fund data provided by Morningstar , Inc. Powered and implemented by Interactive Data Managed Solutions.