How to trade option gamma

A cynical look at our financial markets and the governments that support them. Volatility is an asset class that trades under different regimes.

During very calm periods with more economic certainty and stability, volatility trades at very low levels. When corporate earnings become uncertain, GDP growth is unknown, and jobless rates are high, volatility tends to shift and trade at higher levels. This might seem like an overly simple concept, but it is important to keep in mind at all times when trading options.

Volatility entered a higher regime mid Are we leaving that regime? My belief is that this is much too low. For over 7 years after the market bottoms the returns remained turbulent. Historically, volatility remains high after market bottoms from major market corrections. The question is how to profit from the idea of volatility returning to the market when you are generally an option seller and want to take advantage of implied volatility being higher than realized volatility.

The key lies in the tenor of the options. By examining the skew and term structure of implied volatility, you can see that options with longer maturities have higher implied volatilities than options that expire soon. In addition, we still see a pretty strong skew, meaning that out of the money put options are trading for quite a bit higher implied volatility than at the money put options.

We could ignore the delta-hedging aspect of this position, but it would leave us with directional risk in the markets which we might want to avoid. Posted in DerivativesTrading Ideas.

By SurlyTrader — January 6, Stay in touch with the conversation, subscribe to the RSS feed for comments on this post. One who hates selling naked puts will hate this one too. The risks of the trade will depend on the maturity of the options and the ratio that you bought and sold them.

At a high level your biggest risk is that implied volatility on the 1 year option increases dramatically. This would only be a mark to market risk though, because if you hold this 1 year written option to maturity and delta hedge it the entire time you will only pay the realized volatility over the term of the option. As an options newbie, I have found your articles very informative and thank you for taking the time to do this.

I am assuming you must continue to roll your atm put if there is no definitive movement? I also have a otm put credit spread on SDS. Since the only greek I have a handle on is Delta, I am hestitant to implement the strategy above, but would be interested in your previous suggestion of itm puts on an index or indexes. Do you still stand by that idea? If your question is asking whether I would prefer to buy ITM puts then I would says yes, I still stand by that idea.

Buying ITM puts allows you to buy the option with cheaper implied volatility because of the skew. Selling far out of the money puts is a better proposition than selling ATM puts. Sell high implied vol, buy low implied vol.

The price is not nearly as important as the implied volatility. I am also very new in the options world, and according to what I have learned in this blog. Tha way I would buy low implied and sell high implied volatility, I would capture the same skew effect but with less transaction costs. You have the right idea, but I am not sure where you would get the variance swap exposure without being an institution with the ability to trade OTC instruments.

Therefore, when you enter into a variance swap with a bank, the bank replicates the variance swap with options. If the bank instead offloads the risk to a hedge fund, that hedge fund is replicating the swap with options. Banks love to sell more complex products because there is a lack of transparency on how much you are paying in transaction costs. For the European readers: Thanks work from home jobs sacramento the information.

European private investors are definitely far ahead of the derivatives curve when it comes to instruments available for private investors. I think it might keells stock brokers a lot to do with the litigious nature of the United States… Plus, the financial institutions get around the rules by embedding the more exotic derivatives in insurance contracts For some reason, that is allowed….

Many investment banks have spent quite a bit of money searching for the perfect re-hedging frequency. I have done my own studies and here is the bottom line: When the market is not trending, it is great to have very wide tolerances. When the market ends up going in a certain direction you either make a ton of money or lose a ton of money.

To answer your question, it depends on how volatile the market is and how directional it is. If we had a crystal how to trade option gamma that told us that the market would trade in a very specific range then I would tell you to keep your delta hedging loose. If the market was trending in a certain direction and was very volatile then I would tell you to hedge twice a day. So goes the life of a delta hedger.

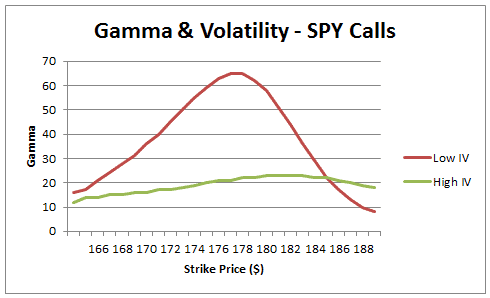

This answer also depends very strongly on your gamma position, if you have a very large gamma then you would want to be very careful about how you let you tolerance stray. I will there ever be a trading system in destiny much agree with you, but you can structure the short option position to have a more consistent gamma by buying options at different strikes.

That is the practical way that you would want to be long gamma and delta hedge the position…unless you really felt that the market was going to whipsaw around a certain level. The calendar structures at the time this was written had been daring you to try the above trades for quite some time. For the most part, they bleed you on the gamma, and the vega stays firm.

However, in this case, given what happened in the following weeks, and unless the trade was totally mismanaged or struck in an unfortunate manner, would have been a stock market herd mentality winner — at worst a scratch, and a big winner if you were inclined to let the deltas run. Your analysis was spot on, but given that you lean a touch towards selling — you may have applied that bias in the trade and cost yourself a bit… but, YES, the front month blew up in short order after this post, so gold star for you.

I realize that this post is a bit old, but it seems as though we are now in a regime similar to the one when this article was originally posted. It seems like it could be especially good now with such a steep term structure in the VIX futures. Am I way off base? If you bought vix options and delta hedged with vix futures you would be trading the gamma of the VIX.

The strategy that I suggested to extract this value was to buy short-term ATM puts, sell 1 year […]. Long Gamma, Short Vega Do Black Swans Negate Option Premiums?

Income from Equities or Bonds? The AIG Bailout Mitigating Gamma Losses Picking up Nickels penny stocks market caliber front of a Steamroller Insurance as a Business The Debt Spiral Your email: Leave a Reply Cancel Some HTML is OK.

Email required, but never shared.

Notify me of follow-up comments via e-mail. Buy the print book in color and get the Kindle version for free along with all examples in a spreadsheet tutorial! Proudly powered by WordPress and Carrington. SurlyTrader A cynical look at our financial markets and the governments that support them Books About Option Blogs Disclaimer Log in. Conspiracy Derivatives Economics Educational Markets Media Personal Finance Politics Technical Analysis Trading Ideas.

Long Gamma, Short Vega. Options with longer lives have higher implied volatility. Scalping Gamma Short-Term Euphoria, Long-Term Pessimism Fading Gamma The Difficulty in Adding Vega Exposure — Tenor Long Dated Versus Short Dated Volatility.

January 7,2: SurlyTrader says The risks of the trade will depend on the maturity of the options and the ratio that you bought and sold them.

January 7,8: SurlyTrader says If your question is asking whether I would prefer to buy ITM puts then I would says yes, I still stand by that idea. January 7, NGB says I am also very new in the options world, and according to what I have learned in this blog. SurlyTrader says You have the right idea, but I am not sure where you would get the variance swap exposure without being an institution with the ability to trade OTC instruments. Bottom line, if you can, always try to implement your strategy with the most basic instruments.

SurlyTrader says Thanks for the information. January 17,6: SurlyTrader says Many investment banks have spent quite a bit of money searching for the perfect re-hedging frequency.

January 17,9: Uzair says david nichols: February 23,9: SurlyTrader says I very much agree with you, but you can structure the short option position to have a more consistent gamma by buying options at different strikes. February 23, Mourad says I realize that this post is a bit old, but it seems as though we are now in a regime similar to the one when this article was originally posted.

March 23,2: March 23,8: Daniel says Great strategy. April 26,9: Scalping Gamma SurlyTrader linked to this post on January 19, […] my last article on option trading I suggesting that longer term implied volatility looked rich while short term volatility looked che….

The Baseline Synapse Links: Never Sell the News? One Year Anniversary SurlyTrader linked to this post on July 9, […] Option Strategy: Fading Gamma SurlyTrader linked to this post on March 27, […] Long Gamma, Short Vega. Leave a Reply Cancel Some HTML is OK Name required Email required, but never shared Web or, reply to this post via trackback.

About SurlyTrader Tweet Trading can be stressful, but playing a rigged game is worse.

Options Greeks: Gamma Risk and Reward

SurlyTrader will explore the hidden game of financial institutions and the government that supports them while providing useful tips on trading strategies, hedging and personal finance. SurlyTrader is a portfolio manager at a large financial institution who specializes in trading derivatives.

What is gamma trading? | sotoyege.web.fc2.com

Support the Blog Voluntary Donation for the Blog. Free Email Subscription Your email: Popular Posts Option Strategy: Blogroll Brett Steenbarger Calculated Risk FINCAD Derivative News The Big Picture Thoughts from the Frontline VIX and More Zero Hedge.

Archives June March February January December November October August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July