Comparison of stock brokers india

Our goal is to help you find the best stock broker for your needs, and to that end, our team has spent over hours reviewing the top online brokerages.

We consider how each stock broker stacks up against the most important factors for investors, evaluating over 15 criteria before assigning each broker a rating or making a recommendation. NerdWallet does not have relationships with every brokerage listed, and our recommendations are completely independent of any partnerships. What do you want to invest in? The first step in choosing an investment account is understanding your investing strategy. Investors who trade individual stocks and advanced securities like options are looking for exposure to specific companies or trading strategies.

Mutual funds and ETFs are typically best suited to investing for long-term goals that are at least 5 years away, like retirement, a far-off home purchase or college.

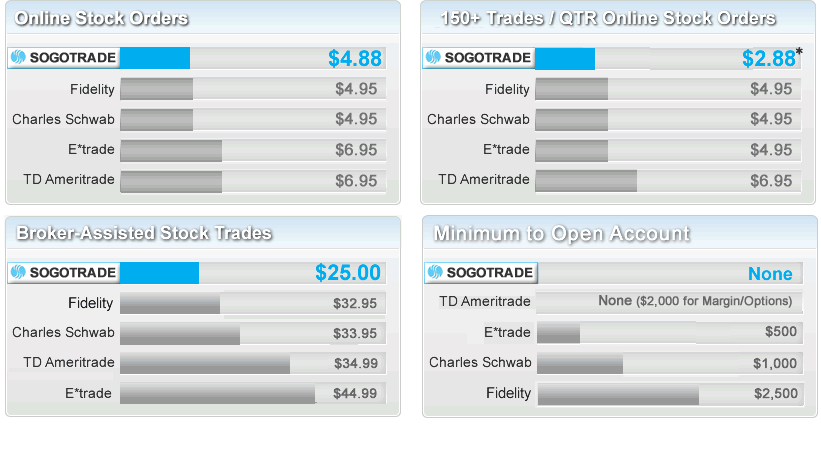

Beginners and long term investors often look to get exposure to whole markets and don't have a preference on which type of securities to trade. How much will you deposit to open the account? Some brokers have minimum deposit requirements, while others may require a minimum balance to access certain advanced features or trading platforms.

If a broker is offering a new account promotion, there may be a minimum initial deposit requirement to qualify. How often will you trade? Like most things, when it comes to stock brokers, you often get what you pay for — which means there may be a trade off between price and quality. Some brokers charge more per trade but offer access to a high-quality platform and premium research for free. Others have lower commissions, but offer fewer tools and services or charge to access certain tools.

If you're trading frequently — more than weekly — you'll want an advanced broker that has powerful platforms, innovative tools, high-quality research and low commissions.

Those who trade monthly or yearly will want a well-rounded broker with a user-friendly interface, helpful customer support and competitive pricing. Who will manage your investments? Yes, it's true — you don't have to manage your own investments.

In fact, these days it's not only possible, but inexpensive to get the kind of management that was previously only available to investors with very high balances read: These services use algorithms to build and manage investor portfolios.

For a very low fee, they'll create a portfolio of ETFs based on your investing goals and risk tolerance, then rebalance it as needed.

Many also offer tax-loss harvesting for taxable accounts. If that sounds too hands-off for you and you want to manage your own investments , choose a self-directed account at an online broker. What is most important to you? Mutual fund and ETF investors want access to funds without commissions or transaction fees; stock or options traders want low commissions and no added fees for inactivity, tools or research.

If you plan to trade frequently, you likely know what kind of tools you'll use most and what you want out of a platform. Website and tools should be intuitive and easy to navigate.

Comparison of Full Service Brokers and Discount Brokers in India

Investing, particularly frequent trading, requires analysis. The broker should provide extensive information to help you select the investments for your portfolio. This shouldn't be your primary concern, but it might be a tie breaker if you're stuck between two options.

Compare Online Share Brokers In India And Find Best Stock Broker In India.

NerdWallet strives to keep its information accurate and up to date. All financial products, shopping products and services are presented without warranty. Pre-qualified offers are not binding.

So how do we make money? We receive compensation from our partners when someone applies or gets approved for a financial product through our site. But, the results of our tools like our credit card comparison tool and editorial reviews are based on quantitative and qualitative assessments of product features — nothing else.

At times, we may receive incentives such as an increase in the flat fee depending on how many users click on links to the broker-dealer and complete a qualifying action.

Log in Sign up. Find the Best Stock Broker. ETFs and Mutual Funds. At least once a week. Every month or so. A few times a year. Sign-up bonus or promotion. Recommended stock brokers for you. Broker Best For Highlights Commissions Account Minimum Current Offers Start Investing Betterment. Best for trading weekly, monthly, occasionally. Best for trading weekly, monthly. Cash bonus for new accounts. Best for trading monthly, occasionally.

Get Started on T. We want to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers.

Any comments posted under NerdWallet ' s official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Credit Cards Banking Investing Mortgages University Partners. Insurance Loans Shopping Utilities Taxes.

About Company Press Careers Leadership. Terms of Use Privacy Policy. Goal-based tools motivate investors to save more.

Up to 6 months of free management. Among largest selections of commission-free ETFs. Large selection; reasonable commissions and fees. Low commissions; superior tools, particularly for options. Top research; two powerful trade platforms; educational content. High-quality customer service with low commissions and fees.

Discounts for frequent traders; among best platforms. Offers a number of tools completely free. Real-time data and charting in a customizable package.

Impressive platform and research depth; low commissions. Industry leader in low-cost mutual funds, ETFs and index funds.

Sharekhan Vs Zerodha - Stock Brokers ComparisonRowe Price Our Review Get Started on T. Direct access to its low-fee, high-quality mutual funds. Award-winning platform, in-depth research, and advanced tools. Automatic-investing program is great for a newbie.