Bullish reversal patterns forex

Oil Crumbles, Cable Reverses and the Dollar Continues with Bullish Structure. Bull Flag Break Opens Door for Continuation.

The Hammer Trigger for Bullish Reversals

Gold, USD Strong Inverse Correlation and in Confluence. FTSE Further Develops Range on Sharp Turn Lower. In our last Price Action article, we looked at trading Bearish Reversals in the Forex Market. The hammer formation tells the trader quite a bit. And not only did prices reverse, but they reversed beyond their initial opening price, thereby creating a bullish candle. This setup can be especially attractive if the long wick on the bottom of the candle is sitting outside of previous price action.

A Bullish Hammer to trigger in direction of previously established trend. Notice in the above picture on the British Pound against the US Dollar, a nice and strong up-trend had formed before running into a retracement in red. During the retracement, a hammer formation forms the same candle we looked at in each of the previous two illustrations. Traders can look at this an entry opportunity, looking for the previously established trend to continue in that direction.

If the previously established trend comes back, the trader can look for 2, 3 or even 4 times the amount they are risking at the outset of the trade. The inverted hammer is another bullish candlestick formation that will often be found at or near the bottom of a retracement in an up-trend.

The inverted hammer is opposite of the hammer formation, in the fact that the bullish body of the inverted hammer is at the bottom of the formation, with a long wick sitting atop the body.

The picture below will illustrate further: The inverted hammer is often found at the bottom of a move, and will indicate a potential reversal in the near-term trend. The logic of this candle is similar to the logic of the hammer. The Shooting Star formation as shown in Trading Bearish Reversals. There are some key differences to note between these two formations.

Firstly, the shooting star is bearish, while the inverted hammer is bullish; and as such, the shooting star candlestick should be bearish, and the inverted hammer should be bullish.

But perhaps more importantly is the context of the market at the time of formation. Shooting stars take place at the top of a move.

And just like we looked at in Trading Bearish Reversals, trading shooting star formations is optimal in longer-term dow n-trends, with a near-term retracement up-trend. This way the trader can look to the shooting star formation to initiate a short position for a reversal in the near-term up-trend, and a continuation in the longer-term down-trend.

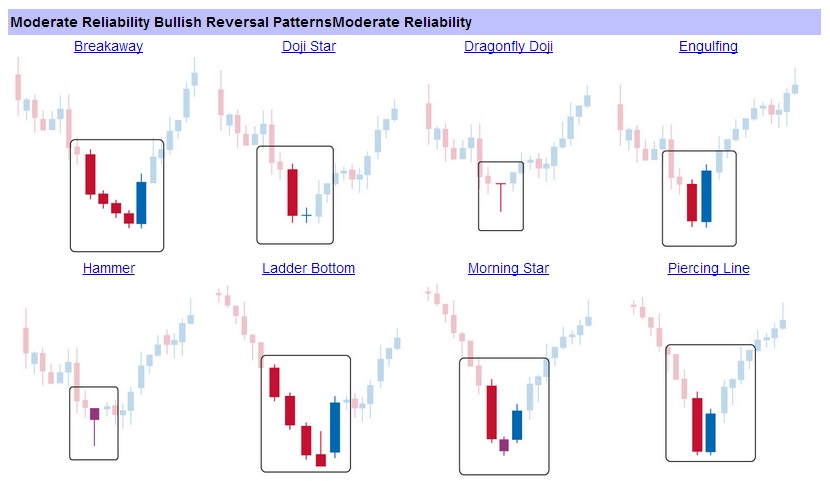

Bullish reversal Candlestick Patterns - FX Words Trading GlossaryFX Words Trading Glossary

As a reversal formation, the inverted hammer should be found at the bottom of a move. But, once again, this can be a near-term down-trend or retracement, found within the longer-term up-trend. The trader can use the inverted hammer to trigger into the position, looking for the longer-term trend to continue, while playing the reversal of the near-term retracement. If you would like more information on this style of trading, our article covering multiple time frame analysis can assist in helping traders separate longer-term trends, from near-term movements.

James is available on Twitter JStanleyFX. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

3 Candlestick Patterns For Market ReversalsMarket News Headlines getFormatDate 'Wed Jun 21 Technical Analysis Headlines getFormatDate 'Wed Jun 21 Bull Flag Break Opens Door for Continuation getFormatDate 'Wed Jun 21 Gold, USD Strong Inverse Correlation and in Confluence getFormatDate 'Wed Jun 21 Education Beginner Intermediate Advanced Expert Free Trading Guides. Click here to dismiss. Get Your Free Trading Guides With your broad range of free expert guides, you'll explore: News getFormatDate 'Wed Jun 21 News getFormatDate 'Tue Jun 20 The Hammer Trigger for Bullish Reversals getFormatDate 'Wed Oct 02 Traders can utilize Price Action in an attempt to find short-term reversals in markets In this article, we touch on five of the most common Bullish Reversal patterns Multiple Time Frame Analysis can be used to trade reversals in direction of longer-term trend In our last Price Action article, we looked at trading Bearish Reversals in the Forex Market.

Trading the Forex Bear Flags to Short the Market getFormatDate 'Tue Sep 24 Learn How to Trade the 1 Chart Pattern-The Bull Flag getFormatDate 'Mon Sep 23 Upcoming Events Economic Event.

Candlestick Bullish Reversal Patterns [ChartSchool]

Forex Economic Calendar A: NEWS Articles Real Time News Daily Briefings Forecasts DailyFX Authors. CALENDAR Economic Calendar Webinar Calendar Central Bank Rates Dividend Calendar. EDUCATION Forex Trading University Trading Guide. DAILYFX PLUS RATES CHARTS RSS. DailyFX is the news and education website of IG Group.