Mortgage vs stock market

Ah, the simple life of a person in a word problem. Jane decides to pay off the loan. The same change in the market caused a smaller change in her portfolio, even though her net worth stayed the same.

Should I Pay Off The Mortgage Or Invest In The Market?This is all grade school math, right? A big, fat, Greek default-style mistake.

Her portfolio got less risky, but her net worth stayed the same. After paying off her mortgage, Jane comes to you for financial advice. What is she, insane?

bankrate-logo

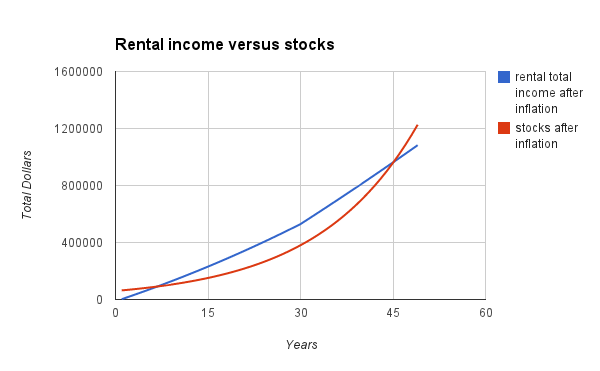

Whether Jane knows it or not, she is borrowing against her house to invest in the stock market, and she should understand the risks. That sounded like a lot of academic drivel, I know. Pay down the mortgage, invest for retirement, or both? Or bonds, for that matter.

Using borrowed money to buy bonds is stupid. Sure, mortgage rates are low.

Thirty Year Mortgage Interest Rate Chart

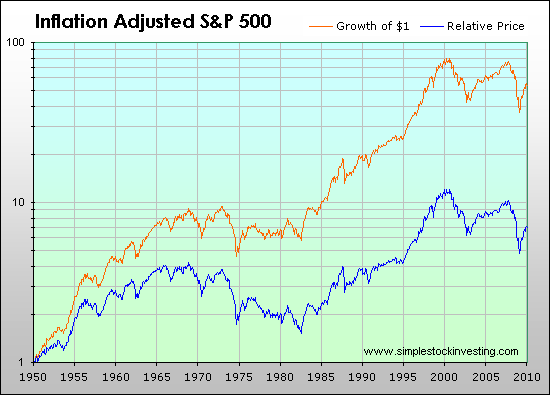

Bond rates are lower. Using borrowed money to buy stocks is dangerous. Stocks bought with borrowed money are more risky. However, this a point both technical and practical.

Pay down the mortgage, but own more stocks and fewer bonds. Clair, a certified financial planner in Roseville, California.

The Correlation Between Mortgage Rates & the Stock Market | Finance - Zacks

Everybody knows you should make retirement saving a habit and do it faithfully, month after month. Nobody needs to be told how toxic negative equity is in , right? If anything, positive home equity offers more flexibility than a k balance. Now, wait a minute.

So while you have a mortgage, what do you do with this money? Nowhere else in the world of finance can you get a year fixed-rate loan with tax-deductible interest and the option to refinance if rates drop. Nearly all of those homeowners would have been better off paying down the mortgage rather than investing, or just keeping their investments in cash.

Yes, I know plenty of them did neither, which compounds the injury. Oh, there is one last wrinkle. In most states, you can walk away from a mortgage. As a forward-looking strategy, however, strategic default sucks. Sorry for the parent lecture.

What do you think? Or has everyone already forgotten ? Matthew Amster-Burton is a personal finance columnist at Mint.

Mintlife Learn about Mint. Intuit and Quicken are registered trademarks of Intuit, Inc. Terms, conditions, features, availability, pricing, fees, service and support options subject to change without notice.