Stock market returns mean standard deviation

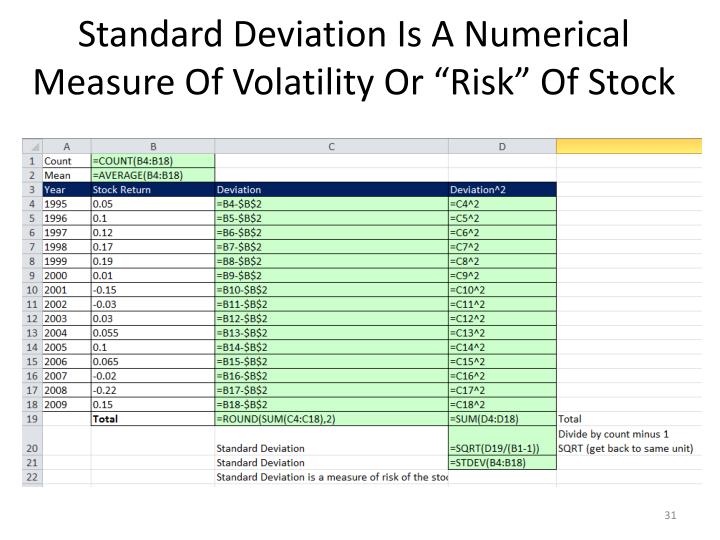

Posted on June 17, by admin. Beta vs Standard Deviation. Beta and standard deviation are measures of volatility used in the analysis of risk in investment portfolios. Standard deviation measures the volatility or risk inherent to stocks and financial instruments.

While both beta and standard deviation show levels of risk and volatility there are a number of major differences between the two. The following article explains each concept in detail and highlights the differences between the two.

In terms of a portfolio of stock, standard deviation shows the volatility of stocks, bonds, and other financial instruments that are based on the returns spread over a period of time.

As the standard deviation of an investment measures the volatility of returns, the higher the standard deviation, the higher volatility and risk involved in the investment. A volatile financial security or fund displays a higher standard deviation in comparison to stable financial securities or investment funds.

Average Stock Market Returns Aren't Average - Marginal REVOLUTION

Unsystematic risk is the risk that comes with the type of industry or company in which funds are invested. Unsystematic risk can be eliminated by diversifying investments into a number of industries or companies.

Standard Deviation

Systematic risk is the market risk or the stock market returns mean standard deviation in the entire market that cannot be diversified away. Standard deviation measures the how to make money buying cars at auction risk, which is both systematic and unsystematic risk.

Beta on the other hand measures only systematic risk market risk. Terms of Use and Privacy Policy: Home Vacancies About Request Article Contact Us. Difference Between Difference Between Things, Terms and Objects.

Difference Between Index Funds and Mutual Funds Difference Between Gambling and Investing Difference Between Debentures and Shares Difference Between FDI and Portfolio Investment Difference Between Equity and Shares. Help us to improve our writing.

Cite This Page "Difference Between Beta and Standard Deviation.

Predicting Stock Market Returns—Lose the Normal and Switch to Laplace - Six Figure Investing

Leave a Reply Cancel reply. Featured Topics Difference Between Scareware and Ransomware Difference Between Ixquick Duckduckgo and Startpage Difference Between Temporary Work Visa and Temporary Skill Shortage TSS Visa.

Latest Posts Difference Between Discretionary and Committed Fixed Costs Difference Between Inoculation and Incubation Difference Between Compensation and Benefits Difference Between Complexing Agent and Chelating Agent Difference Between SMPS and Linear Power Supply Difference Between Annuity and Life Insurance.