Statistical arbitrage fx trading

Before I start this post, let me please set the standard on what I'm hoping to accomplish.

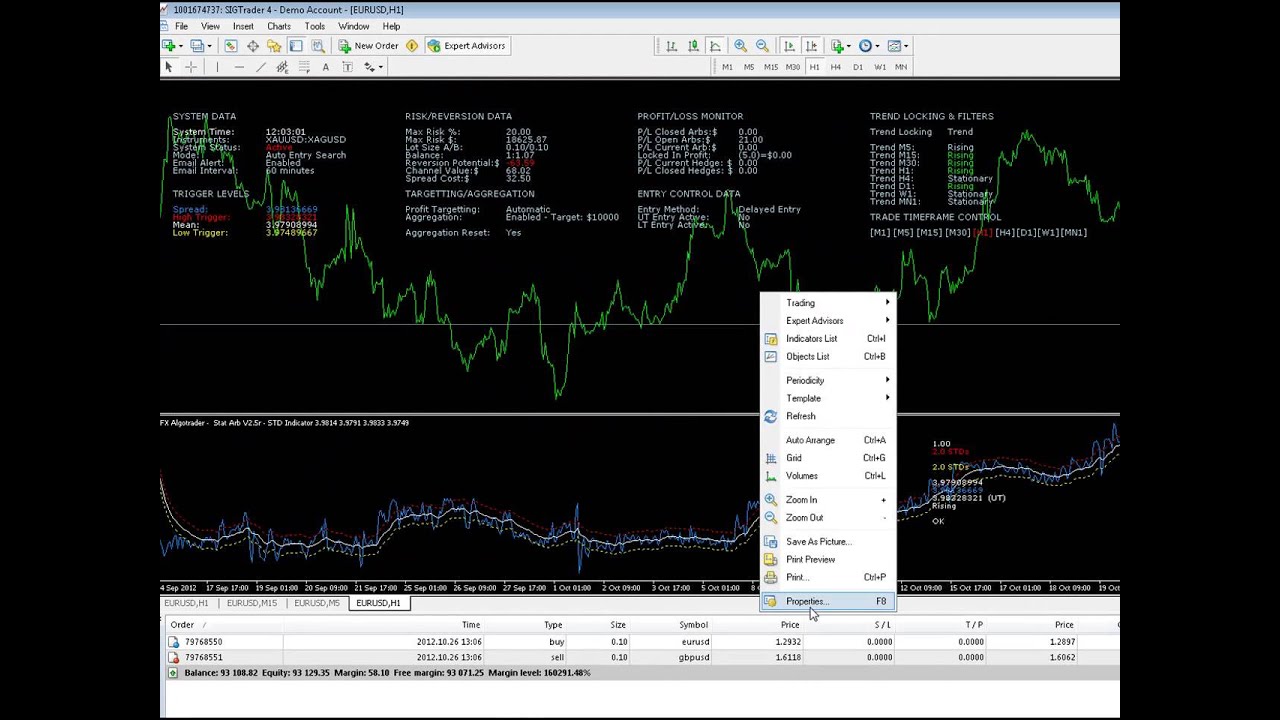

Theory aside, I'm trying to figure out a mathematical algorithm that accomplishes the same base function as the system Kelton originated here:. First, I designed an EA that accurately takes trades when the currency pairs are 20, 40, 60, 80 and pips apart. The max I risk as a function of my entire account balance is 2. Meaning when the drawdown for all my trades is at 2.

I tart trailing prices with stoplosses when the currencies show a separation of less than 3 pips. I do not Scale Fix the currencies.

Forex Brokers: Find the Best Broker for Forex Trading - sotoyege.web.fc2.com

This past week was the first week the EA went into production on two demo accounts. One lost nearly half its balance due to a unique problem that I'll describe below.

Statistical Arbitrage – Correlation vs Cointegration | Gekko Quant – Quantitative Trading

The other is still trading at a modest profit after I did a work around for the problem. Repainting of the currency pairs every 15 - 30 minutes causes older deviations to dramatically change on the M1 charts.

This is what caused a massive loss in one of the demo accounts above.

This creates a HUGE issue but one I think that can be overcome with the correct algorithm for what's really going on. Right now I have a crafty work around but I'm not so confident that I'm about to put real money in. You may have a little difficulty with EU and GU pairs until UK decides to stay with EU, which may never happen. Since the first of the year, UK prime minister has been threatening to leave EU, and this has caused a total disconnect of EU and GU pairs- they are not as correlated as they once were.

If you have a risk protection, it may still work for short term trading, like 1 minute charts. The thing is it turned out to be not much different from directly trading a grid idea on EG pair, which has been really trending since the beginnig of the year.

Still, it might kind of work, again, on small TF for short market exposures.

The only difference from what you are currently trading is to have trades open going the other way, so when the gap between the pairs widen, it is hitting TPs on the way out, not just on the way in. Hope this makes sense, and good luck, again!

Forex - Foreign Exchange (FX) Market Information at sotoyege.web.fc2.com

I use a Pearson running at about days on the D1 and H4 charts to gauge correlation. Despite the hectic nature of the Euro, both currencies are still showing high correlations. This would be a good counter trade idea to offset the losses going in.

Arbitrage Squeezes Profit From Market Inefficiency

I've toyed with this model but the issue is that it assumes that the pairs diverge. The idea was to create a statistical position that could tell us given this, our probability is that and if that doesn't happen, the probability that another event happens, is X.

Problem I'm running into is that Grid trading is ineffective for designing such a strategy on a program. I can teach a program to "see" what I'm seeing but even then, the repainting of data distorts the assumptions used to enter into a trade.

Hence the need for a logical algorithm. I know it's there I just don't know where to look for it. I would also suggest, if you want to dig quite a bit, to look into "R" with Arb-O-Mat. It basically charts correlation using standard deviation, can be useful for looking for stats. Careful with what your doing, I was warned not a lot of brokers really like stat arber's specifically because most of the time your trading against the broker.

I've heard some horror stories about FXCM about the same but haven't heard much about IBFX. Just to refresh everyone that still looks at this thread. The original strategy with vitrite is to flawed and will not work long term.

My strategy does work but in a different way. You must use excel to normalize a set of data and then plot it so it shows the standard deviation of that currency.

You repeat this process for a correlated currency and plot the two on one chart so you can see the gap in standard deviations and when they make a significant gap you buy the underperforming one and sell the over performing one and close once they go back in sync.

I have seen Kelton in action with this strategy and I cannot emphasize just how much of a genius this guy is. Started using his strategy on my live accounts and they work wonders too. I started trading the original version last week and up to now its highly successful You trade negative correlation?

Introduction to Statistical Arbitrage (sotoyege.web.fc2.com)What if the price continued to trend? You would eventually hit margin. EURNZD and NZDCHF, i would decide on buy or sell both depending on EURNZD Theory aside, I'm trying to figure out a mathematical algorithm that accomplishes the same base function as the system Kelton originated here: Free Forex Trading Systems.

Kelton's original model though brilliant had one significant issue: Also you should factor in what the beta is between the pairs your trading.

How did you work around the problem? Also what do you mean by " running Pearson"?? You can see my myfxbook here http: