Corporate fx hedging strategies

The right way to hedge | McKinsey & Company

Hedging can improve foreign earnings predictability, protect the value of the business and reduce the volatility of foreign currency cash flows. In turn, the overall volatility of the business can be reduced, leading to a more stable stock price and higher valuations.

Typically, treasurers choose the hedging tenor, instrument and timings based on a number of factors, including: How a company hedges its FX exposures is generally determined when its risk management policy is formalised, and this often remains unchanged for many years.

At a time when the geopolitical landscape is constantly changing, ensuring the risk management policy adequately reflects the external risks the company faces is vital — particularly when it comes to currency risk. There are a number of strategies that corporates can employ to do this, and we look at two of these below.

Today, many corporates approach FX risk management by forecasting their exposures over the short term and hedging the most immediate risks. This process is repeated over the life of the exposure. While this approach may be simple, it may also have unintended consequences. For example, the company could be locking itself into forward rates that may not turn out to be favourable retrospectively.

Also, the hedge may not capture the full size of the exposure. In addition, the settlement of the hedge could result in a large, negative mark-to-market impact. This, in turn, may lead to a reduction in credit capacity. A layered hedging policy starts by forecasting the exposures over a medium-term horizon, generally 18 months to three years, which is normally in line with the corporate financial model. A number of hedges — for different notionals and over different time periods — are then executed, as the following example illustrates.

A UK fashion retailer purchases clothes from China and India — two countries that tend to bill in US dollars. To minimise transaction risk, the retailer ideally wants to hedge its US dollar cost exposure across a number of retail seasons. There are also fewer associated mark-to-market swings as the hedges are layered at varying rates and in smaller sizes.

Moreover, the ability to respond to changes in forecasted exposures is improved. Admittedly, this method is by no means revolutionary, but it does reflect many of the benefits of a periodically re-evaluated hedging policy.

Using a combination of forwards and options is another way that treasurers can seek to improve the effectiveness of their hedges. While options on their own can be useful, for example, if your business cash flows are particularly uncertain, the premium cost of an option often deters a corporate from using them. If you buy option protection and the market moves against you, then paying the premium is worth it. But if the market moves in your favour, the option becomes obsolete and the premium becomes a sore point.

As outlined, the participating forward can offer significant benefits over an option-only strategy, but there are ways that the participating forward can still be further optimised.

It builds on the conventional instrument, looking to lock in favourable FX moves with FX forwards. By doing this throughout the life of the instrument, the achieved protection rate can be improved.

Looking at figure 2, we can therefore see that the dynamic participating forward can offer improved hedging levels when compared with the more conventional methods.

But this is just one example of how active management of FX hedges can optimise their effectiveness. There are many other methodologies that could be applied to achieve similar improvements.

What this means is that there are a variety of ways in which a treasurer can get more value out of their hedging strategies — and that FX hedges really do benefit from regular evaluation. Naturally, not all treasurers will have the time or resources to do this, but by working closely with your banking partner, it should be possible to make sure that you are getting the most out of your hedging strategy, while being able to respond to changes in the underlying economic and political environment.

Ashley Garvin is an expert in financial risk advisory at Lloyds Bank Commercial Banking. Keep up to date with treasury news and offers from the ACT Be the first to hear of treasury news, regulatory change, plus receive discounts on ACT event tickets and more.. The Association of Corporate Treasurers, 68 King William Street, London EC4N 7DZ.

The Treasurer HOME BRIEFING COMMENT INSIGHT SKILL SET CAREER Treasury Trends Reports VIEW CURRENT EDITION VIEW DIGITAL ARCHIVE Middle East Treasurer RETURN TO ACT HOME.

Corporate FX Risk Management | Global Reach Partners

You are here Home. TheTreasurer Linkedin Facebook Twitter RSS.

Currency Hedging Strategies for Companies - WSJ

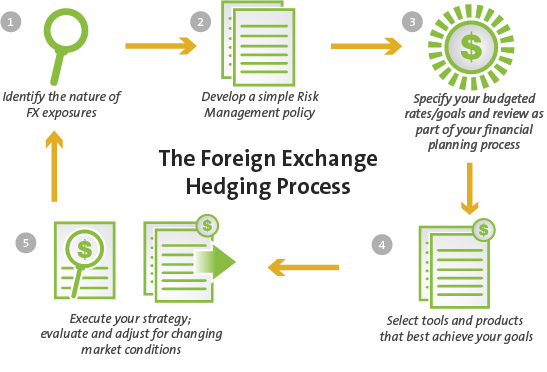

Does your company need to take a more proactive approach to managing FX risk? Shaking off the legacy How a company hedges its FX exposures is generally determined when its risk management policy is formalised, and this often remains unchanged for many years. Thinking differently Today, many corporates approach FX risk management by forecasting their exposures over the short term and hedging the most immediate risks.

Harness your hedges | Association of Corporate Treasurers

Improving effectiveness Using a combination of forwards and options is another way that treasurers can seek to improve the effectiveness of their hedges. About the author Ashley Garvin is an expert in financial risk advisory at Lloyds Bank Commercial Banking.

Keep up to date with treasury news and offers from the ACT. Events, Conferences and Networking.